Kathmandu: Life insurers’ new business premium income declined by 28 percent in the eighth month of the current financial year 2079-80. The life insurers collected a total of NPR 18.55 bn in the month of Falgun in comparison to NPR 25.9 bn in the same month of last FY 2078-79.

The life insurance business is facing negative growth amid the economic recession caused by high inflation. The double-digit interest rate on term deposits has also a negative impact on the life insurance business. The customers make a comparison between the expected return from the life insurance savings and bank term deposits. The average annual return from life insurance savings is 6 percent against an 11 percent return on term deposits. Moreover, the political instability and liquidity crunch among financial institutions also made the public less prioritize long-term investment in life insurance policies.

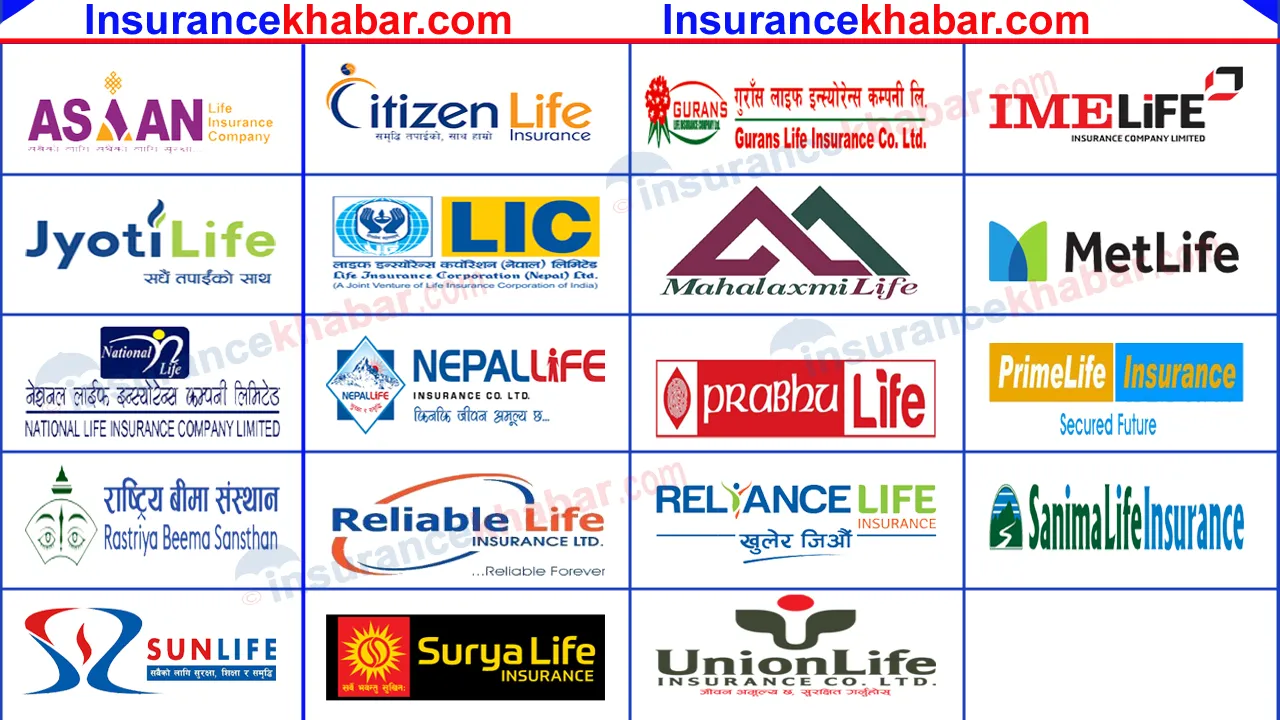

The business premium of Gurans Life, Union Life, and Prime Life, which are in the process of merger, declined the most. The new business insurance premium of Gurans Life Insurance decreased by 51.2 percent in the month of Falgun 2079 as compared to the same month of last FY. Similarly, the new business premium of Union Life declined by 47.74 percent as compared to the Falgun month of last FY.

Nepal Life, which earns the highest insurance premiums, witnessed a decline in new business by 20.79 percent. The company collected NPR 3.47 billion first insurance premium from new business in Falgun compared to NPR 4.38 billion from Falgun last year. National Life’s FPI decreased by 18 percent to NPR 2.31 billion. Similarly, the FPI of Suryajyoti Life, declined by 28 percent to NPR 1.67 billion.