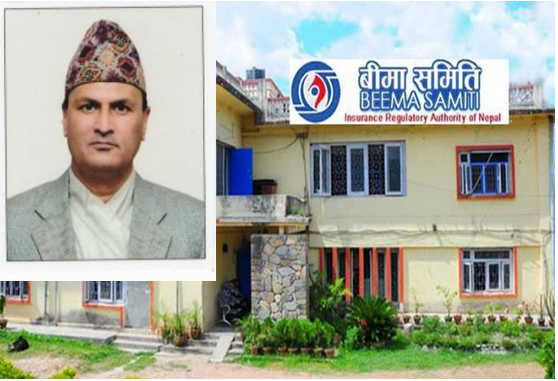

Kathmandu: Beema Samiti, the regulatory authority for insurance companies, has issued Life insurance Policy Directives 2078. Executive Director Rajuraman Poudel informed that the directive has been issued as per clause (d 2) of section 8 clause (D2) of the Insurance Act 2049 BS to maintain uniformity by simplifying and systematizing the policy approval process.

The directive was introduced after the companies showed differences in preparing their own policies. Samiti has stated that this guideline will help the companies to become world class.

The life insurance policy mentions the minimum criteria to be covered, the conditions, the applicable restrictions, the accessibility and so on. Companies need to study the market when preparing insurance products. Similarly, cost benefit analysis, risk identification, assessment and mitigation plan, insurance marketing plan will have to be prepared. The regulator has also stated that the companies will have to make a three-year financial projection.

Samiti is of the view that this guideline will help in preparing an insurance policy suitable for Nepal’s environment. The directive stipulates that the it will not be allowed to surrender the policy and provide loan for two years after the issuance of the insurance policy.

Similarly, the provision of not allowing to surrender single premium policy before the completion of three years from DOC of the insurance policy and no loan will be issued till 3 years by keeping the insurance policy as collateral.

In the case of revival of personal insurance policy, the directive has also addressed the provision of charging interest and waiving interest. It has to be implemented within six months of the Samiti’s approval to issue the insurance products. It is said that if the insurance product is not issued within six months, it will be canceled automatically.But at the request of the company, if the Samiti deems it appropriate, the way can be opened for additional six months.

It is not allowed to use the terms and ambiguous terms while advertising the insurance products. The company will have to post all the details of the policy on its website. Samiti is of the opinion that this directive will restrict misleading information. If the companies want to sell the policy formally, they have to get approval from Beema Samiti. The company has to provide a suitable reason for this. This directive has provided that if the policy has to be sold by paying insurance premium of more than Rs..0.5 million the the source of income must be declared.