Kathmandu: Beema Samiti, the insurance regulatory authority, has directed all insurance companies not to issue policies in credit. Samiti has issued a circular to the chief executive officers of insurance companies saying that they are receiving complaints and grievances of issuing insurance policies without realising the amount of insurance premium received through cheque.

According to the provisions of the Insurance Act 2049 and the Insurance Regulations 2049, no insurer should accept the insurance risk until the premium for any type of insurance business is paid. The insured will be considered insured only after receiving the premium amount for taking the risk.

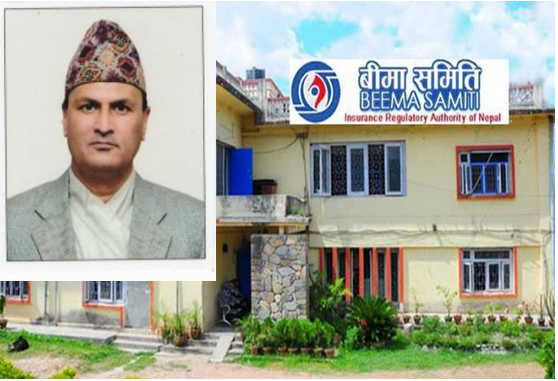

Raju Raman Poudel, executive director of Samiti, said that the CEOs have been advised not to do such thing as it would be illegal for a company to issue such policies.

As it is the responsibility of the CEOs to prevent such illegal activities, attention has been drawn to be vigilant in this regard and to abide by the provisions prescribed by law.

Life insurance companies have been issuing policies in credit to show that they have earned a lot of premiums at the end of the financial year. Similarly, non life insurance companies too issue policy in advance before receiving the premium from their customer.

Chairman Surya Prasad Silwal informed that Samiti will now closely monitor the activities of all the companies as the fiscal year is coming to an end. For this, the regulator is preparing for daily supervision of the companies. There is only 10 days left till the end of the fiscal year. During this period, policies worth crores of rupees are issued.

It is believed that above 30 percent of the annual FPI is collected by the life insurers during the last few days of a FY. It happens so because agencies make every effort to meet their annual target and qualify for the annual benefits offered by the insurance companies.