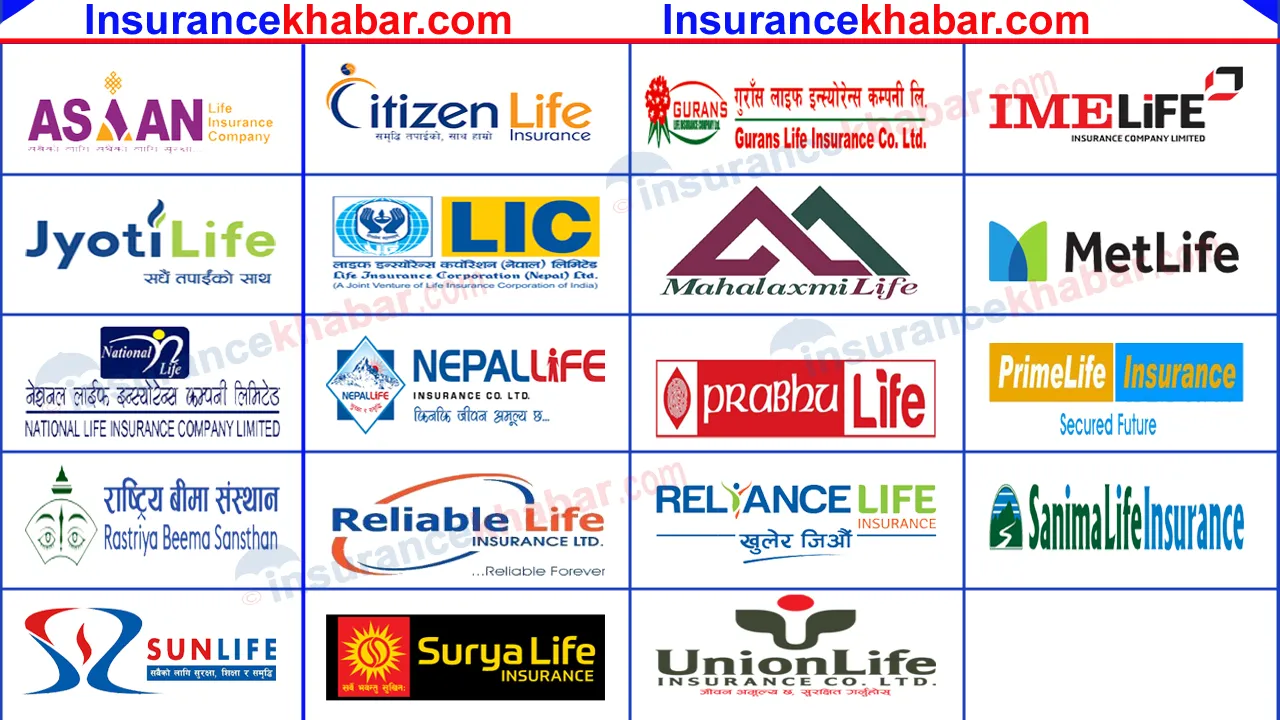

Kathmandu: Life insurance companies earned a total of Rs. 71.5 billion rupees insurance premiums by the end of the 2nd quarter of the current fiscal year 2079-80. According to the data unveiled by the Nepal Insurance Authority, the total insurance premium income of 19 life insurers increased only by 0.20 percent as compared to the 2nd quarter of last FY 2078-79.

The business growth rate of Nepal Life Insurance has slowed down during the current FY. The company has increased its business by only 1.32 percent in the Paush end of the current FY as compared to the same period of the previous FY. The company earned Rs.18.86 billion till Q2.

In terms of growth percentage, IME Life Insurance Company has managed to increase its business by 19 percent to Rs.1.95 billion till Paush end 2079.

LIC Nepal has increased TPI by 4 percent to Rs. 8.72 billion in Q2 FY7980. Similarly, National Life Insurance earned Rs.7.68 billion. National Life witnessed an increase of 13 percent as compared to the same period of the previous FY.

During the review period, the TPI of Met Life, Asian Life, Gurans Life, Union Life, Prime Life, Jyoti Life, Sun Nepal Life, Reliable Life, and Prabhu Life declined. Similarly, there is a minor improvement in TPI Rastriya Beema Sansthan, Reliance Life, Citizen Life, Sanima Life, and Mahalakshmi Life.

During the period under review, state-owned life insurer, Rastriya Beema Sansthan earned Rs.6.14 billion. Met Life Rs. 2.55 billion, Asian Life Rs. 3.46 billion, Surya Life Rs. 2.8 billion, Prime Life 2.26 billion, Union Life 3.75 billion, Jyoti Life 1.47 billion, Sun Nepal Life 1.94 billion, Reliance Life Rs. 1.55 billion, Reliable Nepal Life Rs. 1.78 billion, Citizen Life Rs. 2.66 billion, Sanima Life 1.24 billion, Prabhu Life Rs. 1.03 billion, Mahalakshmi Life Rs. 750 million.