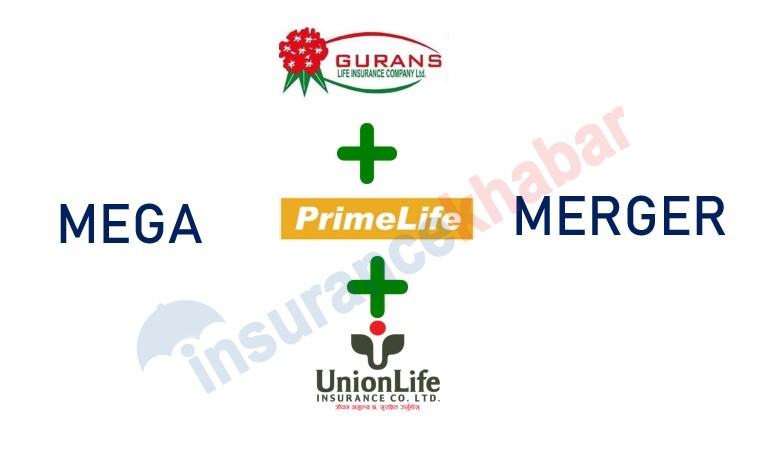

Kathmandu: As soon the Insurance Board has instructed the insurance companies to double their minimum paid-up capital, the merger of insurance companies has started. With a target of paid up capital of Rs 2.5 billion for non-life insurers and Rs. 5 billion for life insurers in a short span of time, many companies seem to have given priority to mergers. Among non-life insurers, Everest Insurance and Himalayan General Insurance have already signed the MoU for merger while among life insurers, Guransh Life, Prime Life and Union Life Insurance have signed a MoU for merger.

Union Life Insurance is the youngest one among these three life insurers. A comparative study of these three life insurance companies by insurancekhabar.com based on the third quarter of FY 78/79 is given below:

Based on paid up capital:

According to the financial statements published by the companies in the third quarter of the current fiscal year, the paid up capital of Guransh Life is Rs 2.8 billion, Prime Life is Rs 2.77 billion and Union Life is Rs 2.15 billion. After the merger, the company will easily achieve the target of increasing the capital of the Insurance Board. Keeping the the swap ratio aside, the accumulated capital of these three companies is Rs.7,013,866. The regulatory paid-up capital is Rs.5 billion for life insurers which they have to meet by the end of current fiscal year.

Based on reserve fund:

According to the financial statements published by the companies in the third quarter of the current fiscal year, based on the reserve fund, Union Life has accumulated Rs 1.90 billion, Guransh Life has Rs 548.2 million and Prime Life has Rs 505.4 million.

Based on Life Insurance Fund:

According to the financial statements published by the companies in the third quarter of the current financial year, Prime Life has a life insurance fund of Rs 17.63 billion, Guransh Life has a life insurance fund of Rs 12.06 billion and Union Life has a life insurance fund of Rs 10.34 billion.

Insurance Premium Earnings:

According to the financial statements published by the companies in the third quarter of the current fiscal year, Union Life has earned Rs 6.22 billion, Prime Life Rs 3.55 billion and Guransh Life Rs 2.38 billion for the first nine months of the current fiscal year.

Based on net profit:

Looking at the financial statements published by the companies in the third quarter of the current fiscal year, based on the first nine months of the current fiscal year, the net profit of Prime Life is Rs. 189.5 million, net profit of Guransh Life is Rs, 131.6 million and net profit of Union Life is Rs. 27.2 million.

By book value:

According to the financial statements published by the companies in the third quarter of the current fiscal year, the book value of Union Life is Rs 156, the book value of Guransh Life is Rs. 129 and the book value of Prime Life is Rs. 124.

A team of actuaries and auditors have already been appointed for actuarial valuation and Due Diligence Audit(DDA) of these companies. It has been claimed that the merger process will conclude within the current fiscal year.