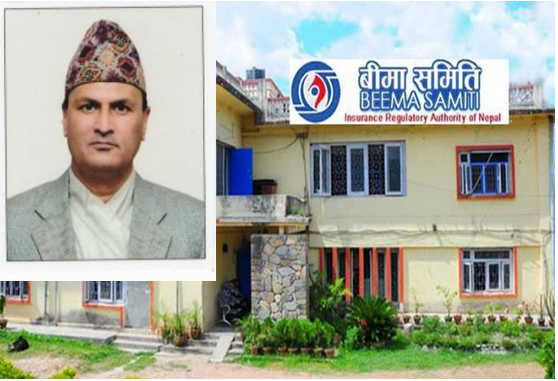

Kathmandu: Chairman of the Insurance Board Surya Prasad Silwal has announced that a provision to charge penalty against delayed claim settlement is in offing. Addressing an interaction program of Chief Executive Officers(CEOs) of all life and non-life insurance companies, he further warned that any lame excuse for delay in claim settlement won’t be tolerated from now onwards.

He further clarified that penal interest will be made effective from the very next day of the maximum period for claim settlement. As per the Insurance Act 2049, an insurer is obliged to make a settlement of an insurance claim within 15 days of the application with due documents submitted by the client. Stating that the main task of the IB is to protect the interest of the insured as well as the overall development and expansion of the insurance industry in the country, he said, ‘As a regulatory authority we cannot remain blind on poor service delivery.

Chairman Silwal has said, After a decade, the insurance industry will have more funds than banking industry, so all our efforts must be concentrated towards the expansion of insurance service to every sector and for the security of the insurance funds. The CEOs shared the challenges faced by the insurance industry and roles that the regulatory authority can play to address it. Further, they also mentioned that the provision for future bonus has created adverse impact on the business growth of the industry due to poor current policyholder’s bonus rates.

The executive Director Raju Raman Paudel clarified that the provision of future bonus has been introduce to safeguard the interest of the insured. So, there’s no room for any changes in the policy.