On one recent evening, I had noticed text message from an unknown lady on my facebook messenger. The text was an inquiry about discount on insurance premium.

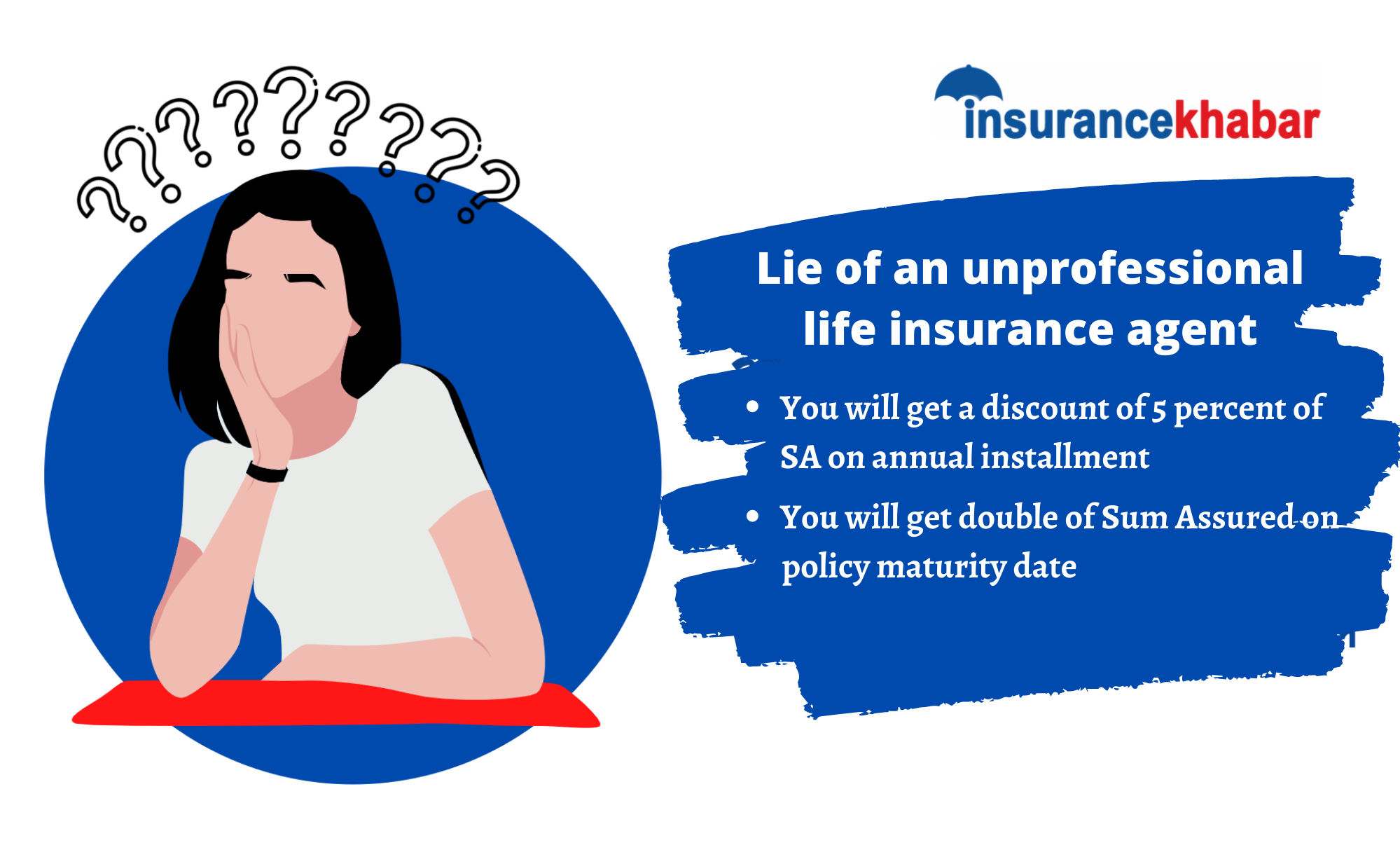

Her query was about how long will the discount scheme continue? At first, I thought it’s just about the recently launched cash-back scheme on renewal premium payment through digital wallets. But she mentioned that she has recently purchased a life insurance policy that offers an annual discount of 5 percent of Sum Assured on premium payment.

I just denied any of such offers and tried to make her aware about the real benefits of the annual money-back policy she has purchased. Knowing the reality that the money returned through annual money-back will be deducted to the Sum Assured, she became disappointed and felt cheated by her life insurance agent. Further, she was briefed that she will get just double of her SA which too was a lie.

During the interaction with her, it was clearly understood that she became victim of misselling by the agent. In fact, she was cheated.

She has purchased annual money-back policy with a Sum Assured of Rs.20 lakh her annual installment is Rs.1 lakh 50 thousand.

She shared, ‘I belong to a lower middle class family. I had my savings which I have poured on the first installment with the fear that I will be deprived of the discount scheme if I make any delay in purchasing the life insurance policy.’

How was she cheated?

She is a housewife. Her husband is a vegetable seller. She assists her husband in his business. She relied on the false information and assurances given by an acquaintance’s agent. She was made a ‘victim of misselling’ by giving completely wrong information about the insurance plan where she gets 5 percent of the SA every year after the completion of first one year from the date of commencement.

Under this insurance plan, 5 percent money back is received annually during the insurance term and after the completion of the term, the insured gets the remaining percentage of SA along with the vested bonus. For example, an insured has purchased a policy of SA Rs. 1 million by paying Rs. 75,000. The insured pays Rs. 75,000 as the first installment. After the completion of one year from the date of policy issue and at the time of payment of the second installment, the insured receives 5 percent of the SA i.e. Rs. 50,000 as partial money- back. At the time of paying the second installment, the insured has two options, the first option is to pay the full premium of Rs. 75,000 and receive the money back of Rs. 50,000.

The second option is to adjust the premium installment without taking the money-back and pay the balance amount i.e. Rs. 25,000 for annual premium installment.

However, the agent had briefed her that she will get a discount of 5 percent of SA while paying the annual installment and after maturity period total SA and vested bonus will be payable. The agent even encouraged the woman to take advantage of the opportunity as the insurance company had brought this plan only for the Dashain Festive.

When the picture became clear to her, she regretted that she had been deceived and regretted that the agent had lied. She asked, “How can I get my money back?”

She was stunned for a moment after the response that the policy could not be surrendered without payment of three annual installment and completion of three years.

Where will she go now?

I was unable to answer this question. Because, there was no evidence of a dialogue between her and the agent. Here the question arises, how long will innocent people like her be cheated? Most of the agents have misrepresented the annual money back insurance plan to the insured from the very beginning.

Another disadvantage of this plan is that it will always be a loss for the insurer if the policy is surrendered at any stage. Even actuaries have set very poor bonus rates due to the financial risk factor of this plan.

How to be well informed?

Contacting at the head office of the insurance company or visiting the nearest branch office to ascertain whether the information given by the agent is correct or incorrect is wiser act. So when it comes to life insurance, be careful and avoid being victim of misselling.