Kathmandu: Nepal’s first sovereign credit rating(SCR) has been stalled for more than a year. In December 2019, the Ministry of Finance (MoF) assigned Fitch Ratings, a US-based company, to Nepal’s SCR.

No significant development has been made public about the rating yet. Government officials comment that the rating action couldn’t be taken ahead amid the Covid19 pandemic.

What is a Sovereign Credit Rating?

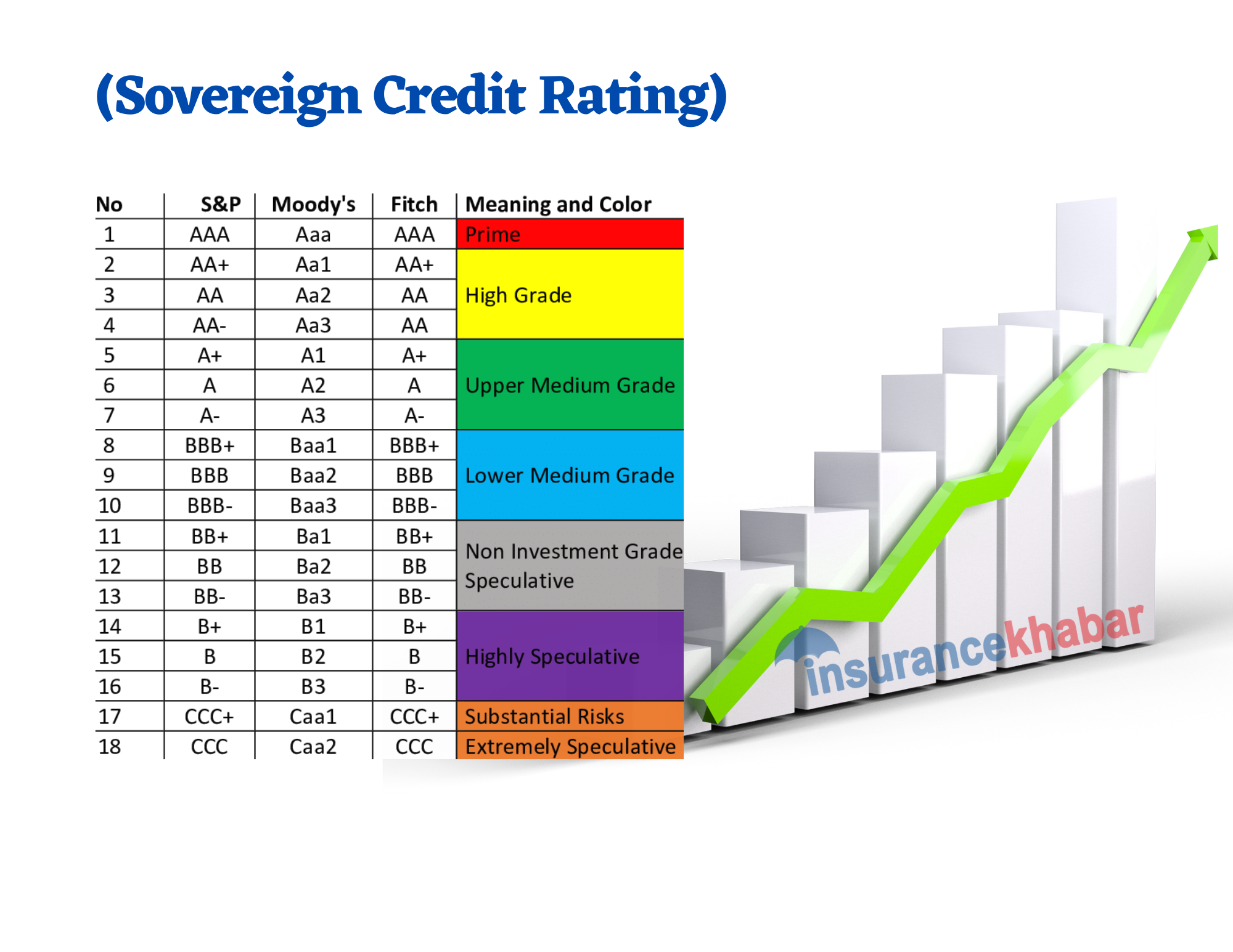

The SCR indicates the ability of any country to repay its foreign debt. It also provides information on the credibility of the government’s policy, institutional, political, and governance systems and how predictable it is. Most countries are at risk of degraded SCR due to the economic downturn caused by the current global Corona pandemic.

What are the benefits of SCR?

SCR would make it easier for the Government of Nepal or the private sector to issue bonds in the international market and raise large amounts of capital for trade or development projects. SCR is supposed to be an important means of raising debt-capital for development by issuing bonds in the international market.

But there’s wide criticism of SCR too. There are also examples of countries whose financial status has gone bankrupt though the credit rating announced a good sovereign credit rating. A few years ago, the European country of Greece was economically bankrupt. Similarly, the Indian government has been criticizing the country’s credit rating agencies in the West World for not being impartial.

Which SAARC countries have a rating?

Afghanistan, Bhutan, and Nepal do not have sovereign credit ratings among South Asian countries (SAARC). Apart from these, India, Bangladesh, Sri Lanka, Pakistan, and the Maldives have their sovereign credit ratings. According to a report released by international rating agencies, the sovereign rating of South Asian countries is risky.

Due to the sovereign credit rating, the Bangladeshi multinational company group Pran has raised 800 million Bangladeshi taka (USD 9.5 million) issuing bonds in the international market. Named Bangla Taka Bond, the bond is listed on the London Stock Exchange.