Kathmandu:The insurance sector regulatory authority Beema Samiti has instructed all insurance companies not to issue policies in credit under any pretext. Life insurance companies have been demanding an additional 48 hours for clearing cheques collected by July 15. They have argued that the working hour is till 5 pm every day and the banks deliver cheque clearing services upto 2 pm only.

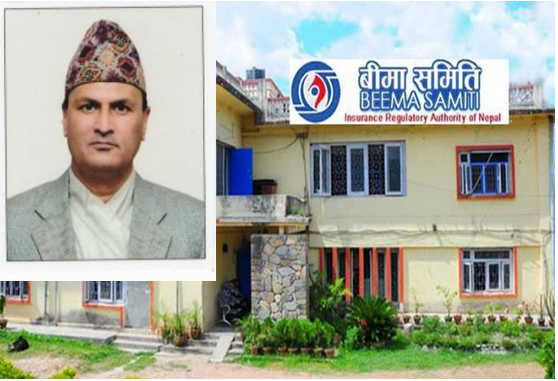

Rajuraman Poudel, executive director of Samiti, said that clear instructions has been given to the insurers not to issue any policy before realising a cheque or receiving cash payment. He added, “If the cheque clearing cannot be done on 15 July then the policy can be issued on the next day after receiving the payment through bank.But you can’t issue the policy without receiving money in advance. ‘

Samiti is of the view that the insurance companies have issued policy on credit to meet annual business target of the agency managers and to show that many policies have been sold within the FY.

According to the Insurance Act, the policy is not applicable without receiving the full premium.On this day, some agents and insurers have been complaining that they will be deprived of additional incentives that they used to get against target achievement due to the new rule as the business won’t be counted on current FY if the first premium payment received through cheque is not realized by 15 July.

According to the rules, the premium above Rs. 1 lakh must be received through cheque or digital transfer.

It has also caused problems for some due to the tendency of insurance company agents to remain passive for 11 months and do business in the last one month of any FY to secure their facilities. Agents are the main business channel in the life insurance business.