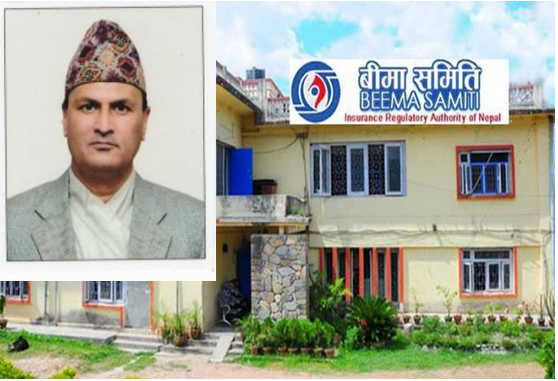

Kathmandu: Chairman of Beema Samiti, Surya Prasad Silwal is in favor to discourage the investment of Banks and Financial Institutions in Insurance Companies. Banks and Financial Institutions have been established for different purposes but in recent days it has been found that huge amount of money is being invested in the insurance companies.

“Banks need to look closely at the issue of increasing and decreasing liquidity,” he said. At present, all the banks have investments in all the insurance companies. It has blocked billions of rupees. If they can use the money to operate the loan, it can pay off well. ‘

According to Dev Kumar Dhakal, spokesperson of Nepal Rastra Bank, banks and financial institutions are allowed to invest within the prescribed limits. Dhakal argues that since banks and financial institutions can invest not only in loans but also in other investments, it will not make any difference.

According to international practice, the source of income of banks and financial institutions is not only interest income but also return on investment by investing in various sectors.

Nepali banks are also earning income by investing in stocks, bonds, mutual funds and other sectors. Some banks are charging fees with LC, various types of bank guarantees. As Beema Samiti,the insurance sector regulator, itself is an autonomous regulatory body, it can issue guidelines on who can make investment in insurance companies.

Dhakal argues that if Beema Samiti thinks that banks should not invest in the insurance sector, it can stop the investment. But he suggests to give some time period for disinvestment from Insurance Companies.

NRB is of the view that it can control the banks if they are manipulating the stock market by buying shares from the secondary market. But if the founders can invest in the shares at the base price, there is no point in stopping them. Dhakal informed that the banks and financial institutions have given permission only for the purpose of getting return on investment rather than leading the sector.

Rastriya Banijya Bank has invested Rs. 500 million and Nepal Bank has invested Rs. 500 million in the newly established Himalayan Reinsurance Company. Moreover, it has been learnt that many banks and financial institutions are in preparation to make investment in the proposed insurance companies. Some investors and businessmen are lobbying through banks to get new licenses. In the context of Nepal, the banking sector is seen as the largest source of investment fund.