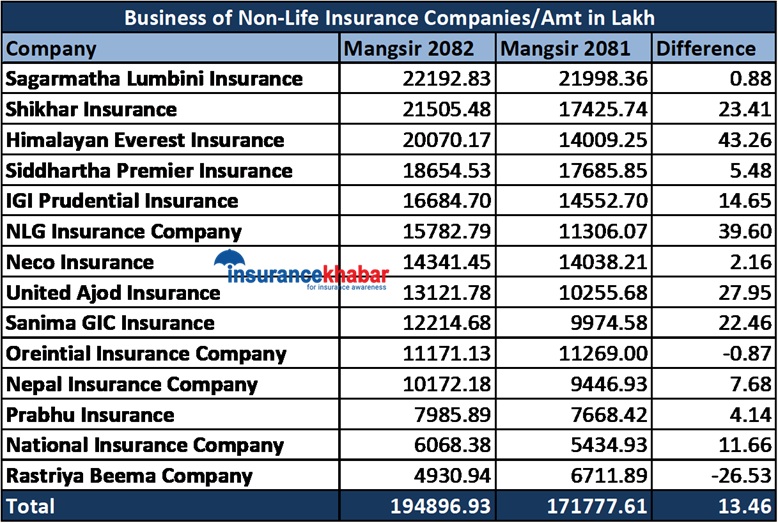

Kathmandu. Non-life insurers in the current fiscal year 2082. In the first five months of 2018, the company has been able to do business of about Rs 19.5 billion.

According to the Nepal Insurance Authority (NEA), 14 non-life insurance companies have issued 1,162,196 policies in the current fiscal year and earned a total of Rs 19.48 billion in insurance premiums. Last year, 2081. As of December 1980, the companies had issued 11,37,272 policies and earned Rs 17.17 billion in total premium. The company’s turnover increased by 13.46 percent in the review period compared to the previous year.

Compared to the previous year, the business of 12 insurers has increased and the business of two insurers has decreased. Sagarmatha Lumbini Insurance has attracted the most business while Himalayan Airbeast Insurance has been ahead in terms of business growth in terms of business growth in the review period.

Sagarmatha Lumbini Insurance has earned Rs 2.21 billion in insurance premiums till mid-December of the current FY. The company had earned Rs 2.19 billion in total insurance premiums in the previous year. The company’s turnover increased by 0.88 percent in the review year compared to the previous year.

Shikhar Insurance has become the second largest business entrant. The company has earned Rs 2.15 billion in total insurance premiums during the review period. The company had posted a net profit of Rs 1,745 crore in the same period last year. The company’s turnover increased by 23.41 percent in the review period compared to the previous year.

Similarly, Himalayan Everest Insurance is the third largest businessholder in the market. The company has earned Rs 2.7 billion in total insurance premiums till mid-December of the current fiscal year. The company had earned Rs 1.40 billion in total insurance premiums in the previous fiscal year. The company’s turnover increased by 43.26 percent in the review period compared to the previous year.

Similarly, Siddhartha Premier Everest Insurance has collected Rs 1.86 billion in insurance premiums, IGI Prudential Insurance Rs 1.66 billion, NLG Insurance Rs 1.57 billion and Neco Insurance Rs 1.43 billion. Himalayan Siddhartha Premier Insurance Ltd, IGI Prudential Insurance Ltd, NLG Insurance Ltd (39.60 per cent), Neco Insurance (2.16 per cent) and Himalayan Siddhartha Premier Insurance Ltd (5.48 per cent) increased their turnover in the review period.

In the current fiscal year, United Ajod Insurance has earned Rs 1.31 billion, Sanima GIC Insurance Rs 1.22 billion and Oriental Insurance Rs 1.11 billion. In the review period, United Ajod and Sanima GIC grew by 27.95 per cent and Oriental Insurance by 0.87 per cent.

Likewise, Nepal Insurance earned Rs 1.01 billion, Prabhu Insurance Rs 79.85 crore, National Insurance Rs 60.68 crore and Rastriya Insurance Rs 49.30 million in the review period. In the review period, Nepal Insurance Company Ltd (NLIC), Prabhu Insurance Ltd (4.14 per cent) and National Insurance Company Ltd (11.66 per cent) witnessed a decline of 26.53 per cent in the review period.